The Richest Kind of Growth (Distributor Benchmarks, Part II)

.png)

.png?width=922&height=369&name=The+Richest+Kind+of+Growth+(Distributor+Benchmarks%2c+Part+II).png)

As we mentioned in the first installment of this mini-series on benchmarking your business, Kevin Kelly is the co-founder of Wired magazine. In 2021, over two million people watched his Ted Talk, “The Future Will Be Shaped by Optimists.”

If there’s anyone who knows, thinks, and dreams about future growth, it’s Kevin Kelly.

Kelly’s futuristic street cred made us rethink how we view growth in the promotional products industry.

Kelly stated (in an interview with Noah Smith), that we often conflate “growth” with two different meanings. “The most immediate meaning is to increase in size … to add numbers, to get bigger. In short, growth means ‘more.’” This is what Kelly calls “type 1 growth.”

But he stated, “There is another equally valid and common use of the word ‘growth’” which means “to develop … mature, to ripen, to evolve.” Kelly said this kind of growth is not about adding but about betterment. “It is what we might call evolutionary or developmental… growth.” In other words, type 2 growth. “It’s about using the same ingredients in better ways. His example: “Standard economic growth aims to get consumers to drink more wine. Type 2 growth aims to get them not to drink more wine, but better wine.”

In our industry, too, distributors and suppliers have two distinct types of growth, and both types of growth are a requisite for future-proofing a thriving business. Since our last article talked about type 1 growth, today, we’ll talk about type 2 growth, the growth that means the real difference between winning and losing: building a richer environment.

Revolutionize Your Promotional Products Business

Seamlessly manage your team, collaborate with suppliers, and delight your clients with software for promotional products distributors.

What is Your Team Engagement Benchmark?

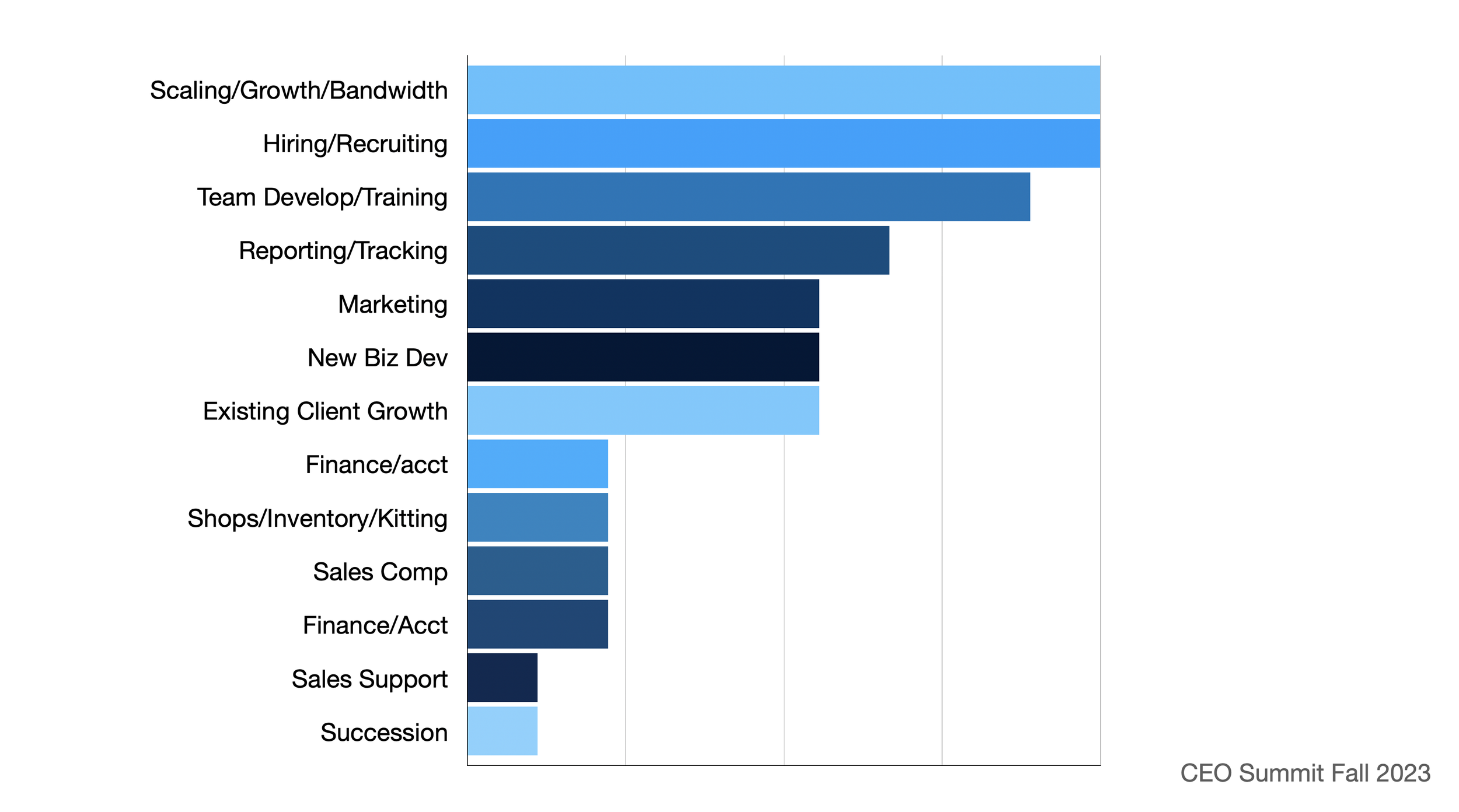

In a recent survey of CEOs in our business, the most pressing concerns for leaders include recruitment, team development, and culture. Most leaders have made culture and engagement a crucial part of their priorities. A disengaged team is a quiet, lethal cost in business. And a disengaged team is no fun for anyone, including leaders!

From our CEO Summit survey of the critical topics facing leaders today.

Joey Coleman, author of the book Never Lose an Employee Again (and our keynote speaker at skucon in Vegas in January), writes, “the Society for HR Management (SHRM) reports that on average, replacing an employee costs six to nine months of the employee’s salary. Gallup’s State of the Global Workplace Report pegs the cost of replacing an exiting worker at 1/2 to 2x the employee's annual salary.”

Let’s put that in perspective with a hardline cost: SHRM shares this example, “For an employee making $60,000 per year, that comes out to $30,000-$45,0000 in recruiting and training costs.”

Joey continues: “Regardless of whether you take the low end or high end of these employee replacement estimates, the fixed expense of rehiring pales in comparison to the costs associated with lost time and wasted energy as a company searches for a new hire, trains them to do the job, then waits while the employee gets up to speed before finally producing as much revenue in profits as they cost in salary and benefits. Organizations that fail to track the true cost of employee turnover lose millions of dollars in profitability that go unnoticed.”

For sales-specific roles, the annual turnover rate is twice the rate of the overall labor force, and the yearly tenure of a sales rep recently dropped from 2.5 years to 1.5 years.

While the tenure of salespeople keeps dropping, the learning curve in promo keeps growing.

Our industry’s learning curve keeps getting higher. More products enter the market each year. More processes for imprinting and packaging pop up every week. More supply chain challenges. More demand for sustainability expertise. More focus on creating a return-on-experience for clients. And more requirements to be a solution seller in a fast-paced environment. If the average sales rep churns in 1.5 years, they’ve only just begun to learn the industry.

Most importantly, companies with a great employee experience outperform the S&P 500 by 122%.

Gallup’s State of the Global Workplace estimated that only 23% of the world’s workforce is engaged. In contrast, through their employee engagement analysis of over one hundred thousand business units, they found that teams that scored high in employee engagement had:

-

23% higher profitability

-

18% higher productivity (sales)

-

14% higher productivity

What should you benchmark against? For turnover, there’s no solid number experts can agree on, but estimates range from 3%-10%. Here’s one resource of many that can help you determine your turnover.

And how about benchmarking engagement? Here’s an impressive one: Gallup’s “2022 Exceptional Workplace Award winners“ averaged 70% employee engagement even during highly disruptive times.” But how can we tell whether your team is engaged? Our Manager of People & Talent, Martha Carscadden, has facilitated a few rounds of engagement surveys with our team and shared these 20 employee engagement survey questions you should ask (from Culture Amp). And for another resource, check out this 12-question culture assessment from the folks at Gallup. A survey likely won’t give you all your answers, but it at least provides a foundation and a benchmark for engagement excellence!

Bonus content:

-

Our chat with the “Teamwork Doctor” Liane Davey, on workplace conflict.

-

Our chat with Joey Coleman, “Never Lose a Company Again.” BTW: Wanna hire Joey to help you even further, click here for some serious expertise an (no, that’s not a sponsored link, we just really dig Joey).

Benchmark: Who’s Your ICP?

Whether you are a distributor or supplier, you do have an ICP, an ideal client profile, and the healthiest, most profitable companies know who their ICP is and focus relentlessly on it.

Sterling Wilson was 22 when he first stumbled into the industry, and now Pop Promos has been recognized as Philadelphia’s #1 fastest-growing company. They've been honored on PPB’s Greatest Companies to Work For list, ASI’s fastest-growing suppliers, they’ve earned spot #135 on the Inc 500 list, and are a highly respected brand in the industry.

In an interview with Sterling (”The Economics of Fast Growth”), I asked him, now that he knows what he knows and has seen amazing success, what would he advise suppliers (and this works for distributors too), to focus on to fast-ramp future success? Sterlings response? Ideal client fit:

We used to say, “We work with all promotional products distributors, but realistically, the difference between different distributors [in] this industry —from spot buys to customer programs where they have their own warehouses and inventory and fulfillment— it’s incredible, the diversity of customers in this industry. We didn't understand our customer well enough for years, and we're still trying to better understand exactly.”

“So, I'd say that first and foremost, get to know your customer. Second, I'd say: pick your customer. We don't service the whole industry. We do not work with everyone. We're not the right fit for everyone. We're really heavily focused on enterprise clients, like 50%+ of our revenue flows to the bigger corporate companies. We focus on quality and making sure the colors are right, and we deliver 99%+ of orders on time or early. And it's a quality play and a service play, but there are lots of different positions within this industry … so get to know your customers and figure out who you're serving because it's not everyone. Try and serve everyone? You can't do it.”

How about you? Have you determined your ideal client fit? What’s your benchmark for a healthy, profitable client as you head into 2024?

An exercise for you: Take your top 10 clients and sort them by declining revenue. Next, create that same list by declining profit. Then, calculate the number of orders you handle for them yearly and begin to create a list to benchmark your best clients. What are their needs? Their buyer psychographics? The services they value the most from you? Creating an ideal client profile benchmark will help you focus on the right kind of growth in 2024.

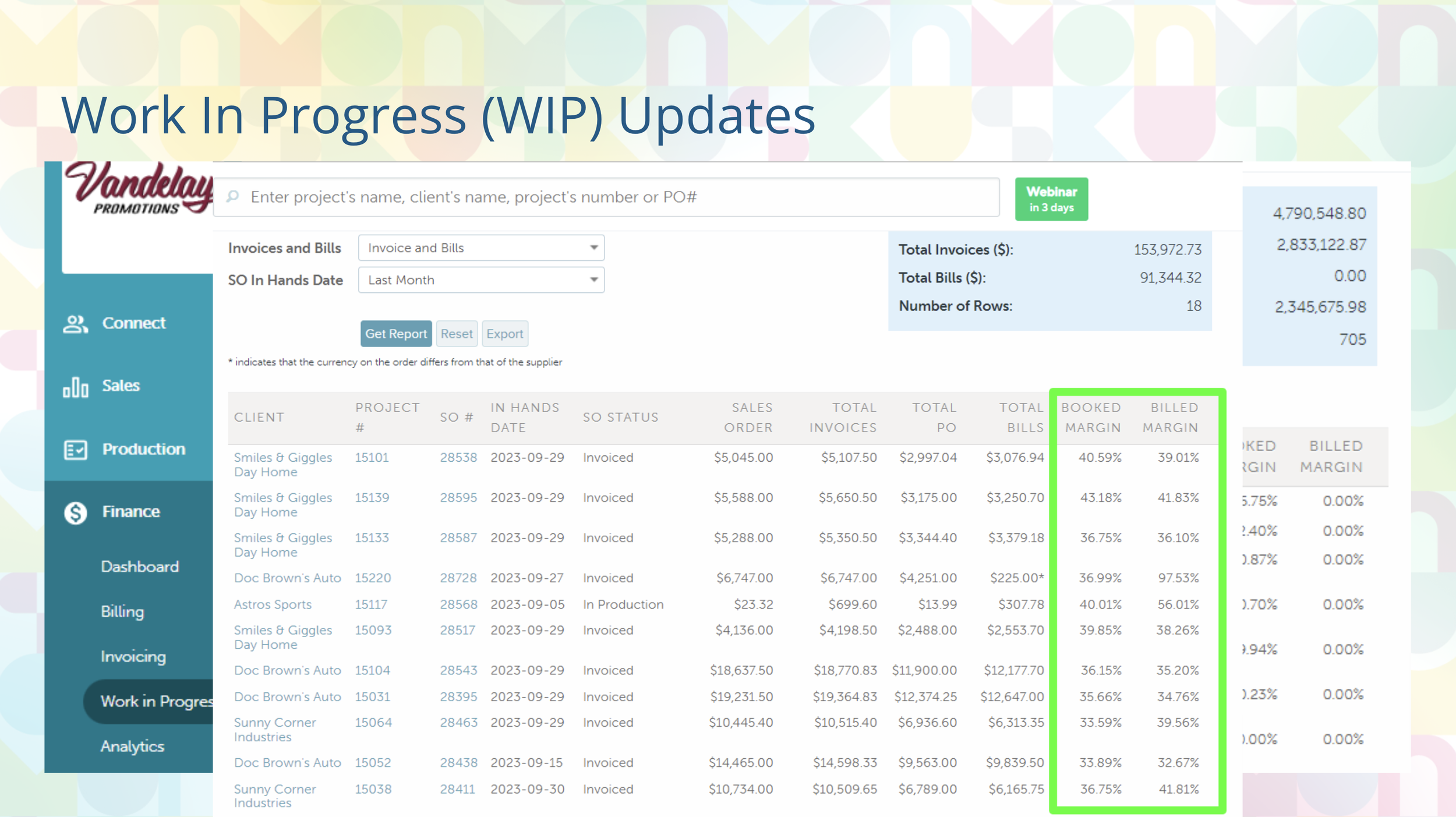

Benchmarks for Margin & EBITDA

PPAI’s Top 100 report revealed that the median gross margin for top distributors is 35%. Average industry margins have hovered around 34-35% for years. The problem with this figure is that if our clients have demanded more and more services (creative, kitting, fulfillment), it could mean —on average— that our margins have stayed the same or improved, but our operating costs have increased. If we are not charging profitably for these services, gross margin doesn’t tell the whole story: What’s the net effect on our bottom line?

At our CEO Summit in June, a gathering of some of the most successful large distributors (and commonsku customers), we talked about a topic very little discussed in our industry and therefore a mystery: What’s the ideal EBITDA for a promotional products distributor? Though distributors vary in their overhead costs, a straw poll among those attending CEO Summit revealed that a healthy EBITDA ranges between 10%-12%, with one distributor achieving a 20%+ EBITDA! Moreover, in a survey of attendees at our second CEO Summit, some attendees’ margin numbers were in the 40%+ category and we’ve even seen some as high as 50%!

An example of commonsku’s WIP report featuring margin.

For benchmarking: Take your ICP, your ideal client list that you worked on from above, what’s your YTD margin with your top-performing clients? Note: This is not a calculated margin over your entire business but rather, just on your most valuable customers (ICP). Are you achieving a minimum of 35%? And how about EBITDA? If you’re not charging for services (creative, fulfillment, kitting), then your bottom line is taking a beating. How does your EBITDA compare?

Scaling vs. Growth

Back to Kevin Kelly’s analogy, there are two types of growth:

-

Type 1 growth: (as covered in our first article) is about adding numbers, getting bigger, growing sales, client count , etc.

-

Type 2 growth: “To develop … mature, ripen, evolve … it’s about betterment.”

Which brings us to the difference between scaling and growth.

-

Growth: increasing sales at (virtually) any cost

-

Scaling: increasing revenue while minimizing cost, thereby creating more efficiency

Often, when entrepreneurs use the word scaling, they mean growth. But profitable growth doesn’t come without scaling. Think back to your years just starting in this business. You began with a book of business that you grew until, one day, you realized you couldn't keep up with it all. You knew that if you wanted to grow, you needed to invest in your infrastructure (type 2 growth: betterment) in a way that would allow you to focus on type 1 growth (adding more).

Without Type 1 growth —adding more— you risk obsolescence, the inevitable decline in clients (businesses merge, sell, or simply move on, and new business growth is a requisite for survival). But without Type 2 growth, you risk destroying the soil of your future growth and destabilizing your business, making it impossible to grow healthily.

Wendell Berry, the great naturalist, has spent his life reminding us that the humble soil we walk upon every day is something we each derive benefit from at every meal. But we hardly give a second thought to how crucial the soil is for our growth. Soil is, in his words, the “great connector of our lives … without proper care for our soil, we can have no community because, without proper care for it, we can have no life.”

The same goes for any business eco-system. Whether on the farm or in your business, type 1 and type 2 growth are both dependent on nutrient-rich, fertile soil.

Go for it in 2024! Add sales, clients, projects, and teams, but remember to set your sights and your benchmarks on two types of growth: both more and better.